Alipay has become one of the most popular and widely used mobile payment platforms in China, making it an essential tool for both locals and travelers alike. With its fast, secure, and convenient system, Alipay allows you to shop, dine, travel, and manage day-to-day transactions all from your smartphone. If you're planning to visit China or just starting out with the app, this guide will help you understand how to shop and use Alipay effectively.

Alipay has transformed the way people shop and pay in China, and it’s become an indispensable tool for locals and tourists alike. From shopping and dining to paying for transportation and managing bills, Alipay offers a seamless, secure, and efficient payment experience. Whether you’re visiting China for a few days or planning a longer stay, getting familiar with Alipay will make your life much easier. So go ahead, download the app, set up your account, and enjoy the convenience of mobile payments throughout your journey in China.

China has embraced technology in a way that allows people to live without ever needing a physical wallet. For foreigners living or traveling in China, mobile payment systems have become a necessity for daily transactions, whether it’s paying for groceries, meals, or transportation. Alipay is one of the two major mobile payment platforms in China, alongside WeChat Pay. If you’re new to China, getting familiar with Alipay is essential, and this guide will walk you through how it works and how foreigners can use it.

What is Alipay?

Alipay is a mobile payment platform developed by Ant Financial, a financial services arm of Alibaba, one of the world’s largest e-commerce companies. While Ant Financial used to be called Alipay, the name now refers to the app itself. With Alipay, users can pay for everything from taxi rides and utility bills to groceries and shopping online. It also allows for seamless money transfers and payments between users. The app is available on both Android and iPhone, and setting it up requires verifying your phone number and bank card.

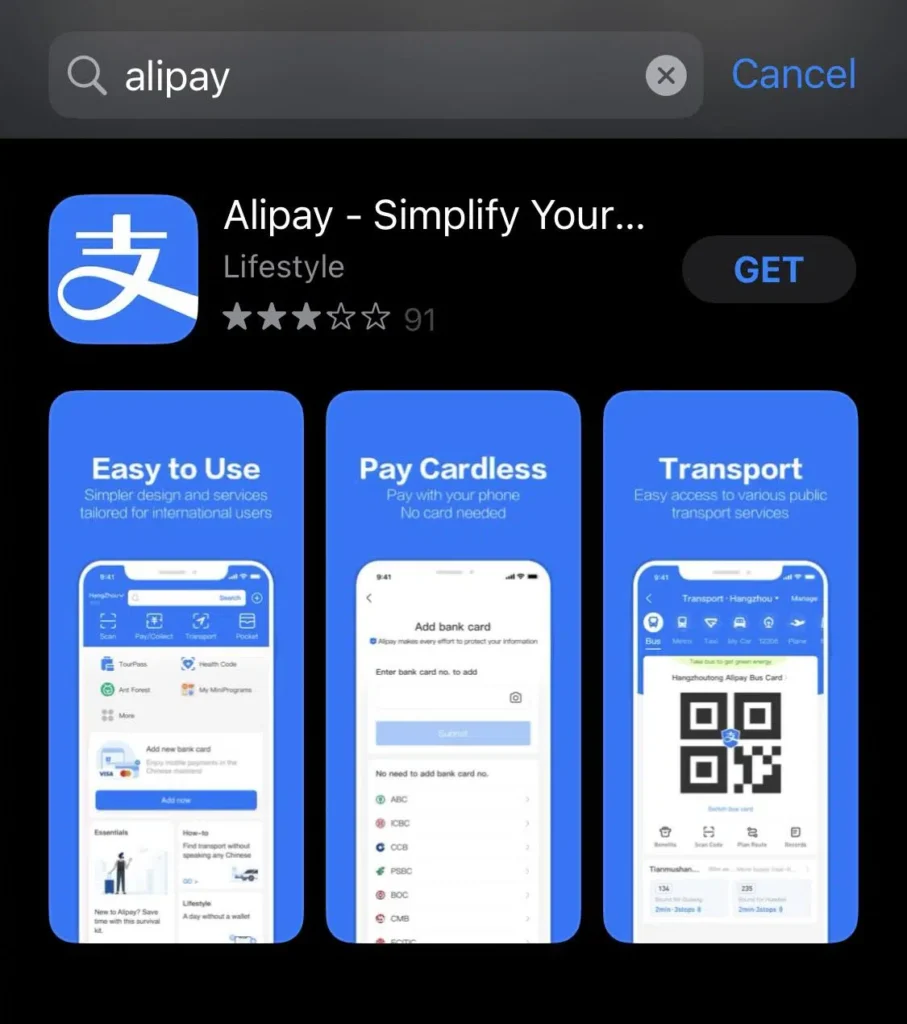

Getting Started with Alipay

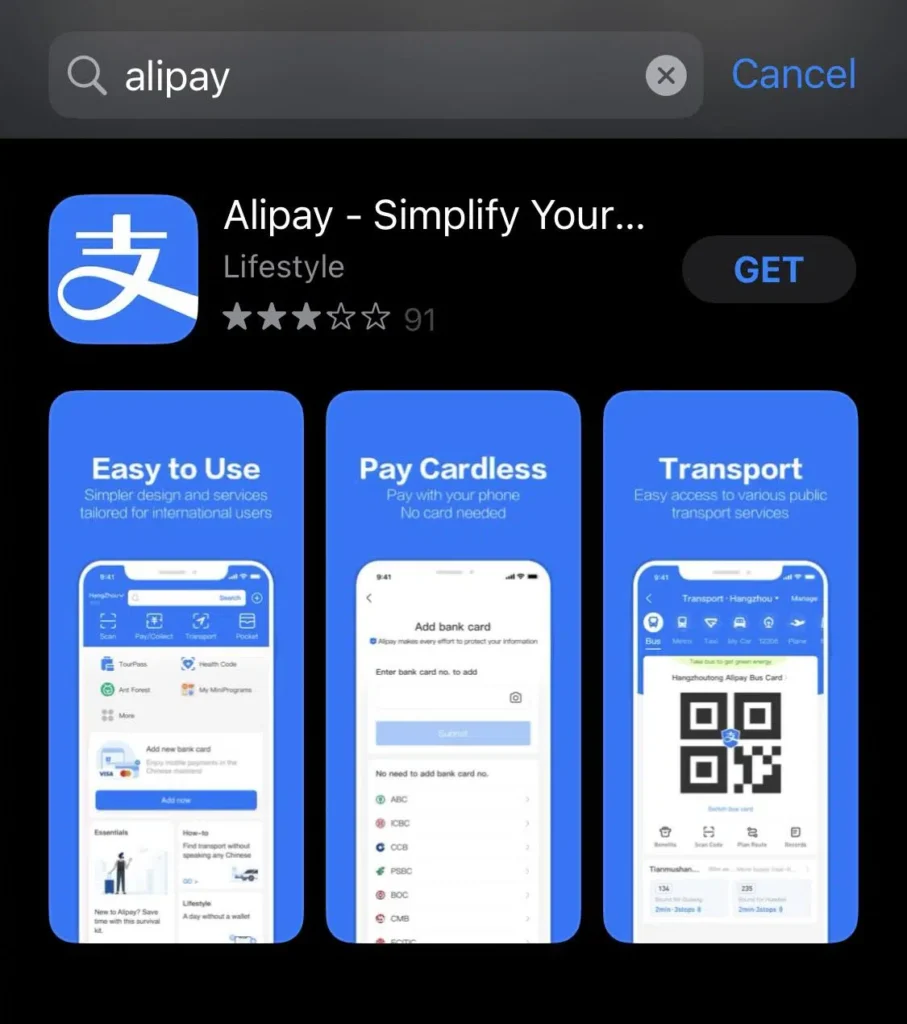

Before you can enjoy the convenience of Alipay, you'll need to download and set up the app. Available on both iOS and Android, Alipay is easy to find and download from app stores. After installation, the next step is registration. If you're traveling, don’t worry—Alipay now allows foreigners to use international phone numbers for account registration. Once you register, you'll be prompted to link a bank card or credit card to your account. If you're in China for an extended stay, it's best to link a local Chinese bank account for smoother transactions. However, travelers can link an international card or use the Tour Pass, a prepaid service that enables foreigners to load funds into Alipay without a Chinese bank card.

Linking a Card or Adding Funds

Once you've set up your account, linking a card is key to making payments. Chinese residents usually link a local bank account or debit card, while travelers often use the Tour Pass feature. Tour Pass allows you to top up your account with a pre-set amount of money (up to 5,000 RMB) for 90 days, which you can use for purchases during your stay. For longer visits, setting up a Chinese bank account gives you more flexibility, but for short-term visitors, the Tour Pass is ideal. Simply top up with your international card and you’re ready to go.

Shopping with Alipay

Once your account is funded, using Alipay to shop in China is incredibly easy. Whether you're at a high-end department store or a local street market, Alipay is widely accepted across the country. To make a payment in-store, simply open the app and select the “Pay” option. A QR code will appear on your screen, which the cashier will scan. You may also encounter situations where you’ll need to scan the merchant's QR code instead. In this case, just use the “Scan” feature in the app, point your phone at the code, enter the amount (if required), and confirm the payment. It’s quick, secure, and incredibly convenient.

For online shopping, Alipay is equally simple. Platforms like Taobao and JD.com—China’s largest e-commerce websites—accept Alipay as a primary payment method. Once you've selected your items and proceed to checkout, choose Alipay as your payment option. You’ll be redirected to the app to confirm the payment. Alipay’s integration with these platforms means you can shop with confidence, knowing your transactions are protected and secure.

Dining and Using Alipay for Restaurants

Eating out in China is one of the best ways to experience local culture, and with Alipay, paying at restaurants has never been easier. Almost every restaurant, from small local eateries to fine dining establishments, accepts Alipay. When you're ready to pay, simply scan the restaurant's QR code, input the amount, and hit “Confirm.” Many restaurants even offer loyalty programs or discounts for Alipay users, making it a cost-effective way to enjoy your meals. If you’re ordering delivery from platforms like Meituan or Ele.me, Alipay is fully integrated, allowing you to pay seamlessly for your meal without ever leaving the app.

Paying for Transportation with Alipay

Alipay’s convenience extends to transportation as well. Whether you're hailing a Didi (the Chinese version of Uber), riding the metro, or paying for a bus fare, Alipay has got you covered. In many cities, you can use Alipay to pay for metro rides by scanning the QR code at the turnstile. Likewise, buses in several cities accept mobile payments through Alipay. If you prefer taxis, simply open the app after your ride and scan the driver’s code to pay.

For tourists, Didi is an excellent way to travel around, and it’s directly linked to Alipay, making it simple to pay for your ride without needing cash. You can also book train and flight tickets using Ctrip or 12306 apps, both of which support Alipay payments.

Additional Services on Alipay

Beyond shopping and dining, Alipay offers a range of services that make daily life in China more convenient. You can pay utility bills, mobile phone top-ups, or even manage investments through the app. Simply navigate to the "Bills" or "Utilities" section, choose the service you need, and complete the payment in just a few taps. If you're traveling, Alipay can also be used to book hotels, buy event tickets, and more, making it a one-stop solution for managing all your financial needs during your stay.

Security and Privacy on Alipay

Security is a top priority for Alipay, and the platform offers multiple layers of protection to keep your information safe. Biometric verification, such as fingerprint or facial recognition, is supported on most smartphones, ensuring that only you can access your account. For added security, make sure to enable a strong password or PIN for your account. Alipay also allows you to track your transaction history, giving you peace of mind that all your payments are properly accounted for.

One thing to keep in mind is that since Alipay is so widely used, it’s important to stay vigilant for any potential scams. Always verify the merchant’s information before making a payment, especially when scanning QR codes. Use the built-in security features of the app to ensure you're making safe transactions.

Is Using Alipay QR Code Payments Safe in China?

As China has embraced mobile payments, Alipay has become one of the leading platforms for cashless transactions. One of its most popular features is the ability to pay with QR codes, which allows for fast and convenient payments just about anywhere, from street vendors to luxury stores. But with the rise of mobile payments, many people wonder—how safe is using Alipay's QR code payment system in China?

Alipay’s Security Features

Alipay takes security very seriously, and the company has implemented a variety of measures to ensure that users’ money and personal information are protected. One of the key features is biometric authentication. Most users are required to set up either fingerprint or facial recognition to unlock the app, ensuring that only the account holder can access their wallet.

Once you open the app, further security measures kick in. For every payment, you need to either input a password or use the biometric verification you’ve set up. This adds an extra layer of protection, especially in case your phone is lost or stolen. For those particularly concerned about safety, Alipay also offers the option to set a separate, high-security password just for payments.

How QR Code Payments Work

The ease of Alipay’s QR code payment system is one of its main attractions. Whether you're shopping at a store, paying for a meal, or even buying fruit from a local market, using a QR code is fast and simple. All you need to do is scan the merchant's QR code, input the amount you need to pay (if it’s not already displayed), and confirm the payment. The process usually takes less than 30 seconds, and you instantly receive a receipt on your phone.

From a security perspective, the QR code system is well-designed. When you scan a QR code, the transaction is encrypted and authenticated by Alipay’s servers, which means the merchant never has direct access to your personal or financial information. This encryption process ensures that the only data shared between you and the merchant is the payment itself, significantly reducing the risk of fraud or identity theft.

Protection Against Scams

While the technology itself is safe, it’s important to be aware of the potential for scams—especially when QR codes are involved. QR codes are easy to create, and scammers can sometimes replace legitimate merchant codes with fraudulent ones to divert payments. Alipay has several built-in features to protect against this. For example, if a merchant’s QR code has been tampered with, the system will often recognize that something is wrong and block the transaction. Additionally, the app will send you a push notification after every payment, so you can immediately verify that the correct amount was sent to the right recipient.

That being said, it's always wise to be cautious when using QR codes. Always double-check that the QR code you're scanning is legitimate, especially in busy public places where scammers could be more active. If possible, confirm the total amount directly with the merchant before completing the transaction.

Fraud Prevention and Reimbursement

Another layer of safety comes in the form of Alipay’s anti-fraud policies. The company has a strong commitment to reimbursing users for any unauthorized transactions. If you notice a suspicious charge, you can quickly report it through the app, and Alipay’s customer service team will investigate the claim. In many cases, if fraud is confirmed, the amount will be refunded to your account. This level of consumer protection gives users added peace of mind, knowing that they’re not completely vulnerable to potential fraud.

To further safeguard users, Alipay uses real-time monitoring of transactions. If unusual activity is detected, such as an unusually large payment or a series of payments made in rapid succession, the system may temporarily freeze your account and notify you. You will then be asked to verify your identity and confirm the transactions before the account is restored. While this might seem inconvenient, it's a strong measure against unauthorized use.

Privacy Concerns

Another common concern with mobile payments is privacy. Alipay collects data on your transactions, but the company has strict policies about how this data is used. Your personal information is not shared with third parties unless you give explicit permission. In terms of privacy, Alipay is highly transparent about its data usage policies, and as one of the largest payment platforms in China, it faces stringent regulations to protect user privacy. However, like any app, you should always review the privacy settings and adjust them according to your preferences.

Using Alipay Internationally

For tourists and expats, the Tour Pass feature has made it easier to use Alipay even without a local Chinese bank account. This feature ensures that international users are subject to the same security protocols as domestic users, so the safety of the app remains high whether you’re using a local bank or an international card. Tourists can enjoy the same level of fraud protection and encryption for their payments, making it a reliable option for short-term visitors as well.

Final Thoughts

In conclusion, Alipay’s QR code payment system is not only convenient but also safe. The platform’s encryption, biometric verification, and real-time fraud monitoring make it highly secure for users in China. While there are potential risks, such as QR code scams, Alipay provides robust protection features and strong customer service to ensure that any fraudulent activity is quickly addressed. By staying cautious and utilizing Alipay’s built-in security measures, you can confidently use QR code payments to shop, dine, and explore China without worry.

Whether you’re a local or a traveler, Alipay has transformed the way people make payments, offering a seamless and secure experience that continues to revolutionize China’s cashless economy.

Setting Up Alipay for Foreigners

To use Alipay as a foreigner, there are a few steps you need to complete. First, you must download the app either from Google Play or Apple’s App Store. Once installed, you'll sign up using your mobile number, which will become your account ID. You will then receive a verification code by text, which you’ll enter into the app to confirm your identity. The next step is to set a password, and if your device allows it, you can enable fingerprint or face recognition for added security.

After successfully signing up, you'll need to link a bank card to your account. For foreigners, this means using a Chinese bank account, as it is mandatory for many features like fund transfers and mobile payments. It’s essential to have a local bank card, but international credit cards like Visa or MasterCard can also be added for some transactions. However, a Chinese bank card is required for top-ups and withdrawing funds from your account.

Verifying Your Identity

Alipay has a strict real-name verification policy. You’ll need to provide your passport number, a local phone number, and a valid Chinese bank account. You may also be asked to upload a photo of your passport for additional verification. Once you’ve completed these steps, you’ll be able to start using the app fully.

Language Settings

Even though Alipay offers an English version, not all parts of the app are translated. You might still encounter Chinese text in some areas. You can switch the language to English by going to the app’s settings, but be prepared to navigate through some Chinese interfaces, especially when dealing with customer service or certain in-app features.

How to Use Alipay

Alipay serves as a complete payment platform where you can transfer money, make payments, and even chat with friends. It’s widely accepted in China and can be used at nearly every business, from local street vendors to large international chains.

For making payments, you have two options: scanning a vendor’s QR code or allowing them to scan your personal payment code. Once the code is scanned, you’ll be asked to confirm the transaction by entering your password or using fingerprint or facial recognition.

Alipay is integrated with many services that make life easier for foreigners. It’s the primary payment option for apps like Taobao (Alibaba’s e-commerce platform), Didi (China’s ride-hailing service), and even for booking train tickets or paying utility bills. You can also transfer money to other Alipay users or bank accounts, making it easy to settle debts or share costs with friends.

One unique feature is the ability to send and receive "Red Packets," or digital envelopes with money, commonly used during special occasions or holidays in China. This feature can be accessed within chat windows with friends.

Adding a Bank Card

To add a bank card, simply go to the “Me” section in the app, then navigate to “Bank Cards” and tap “Add Card.” From there, you’ll enter your card details. The app will automatically identify the issuing bank based on the card number. It’s important to ensure that the name you provide matches the name registered with your bank, as any discrepancies can cause delays or errors.

If you're adding a foreign card, the process is similar. However, note that foreign credit cards may have limited functionality within the app, so it's always better to use a Chinese bank card if possible.